Digitalisation in India will grow in 2025 due to the activity of middle-aged and senior users

The report by Robocash Group reveals that by 2025, 66% of the increase in the number of Internet users will be attributed mainly to the middle-aged and elderly population. The shares of young adults and middle-aged generations will become roughly equal, resulting in an equivalent impact on fintech.

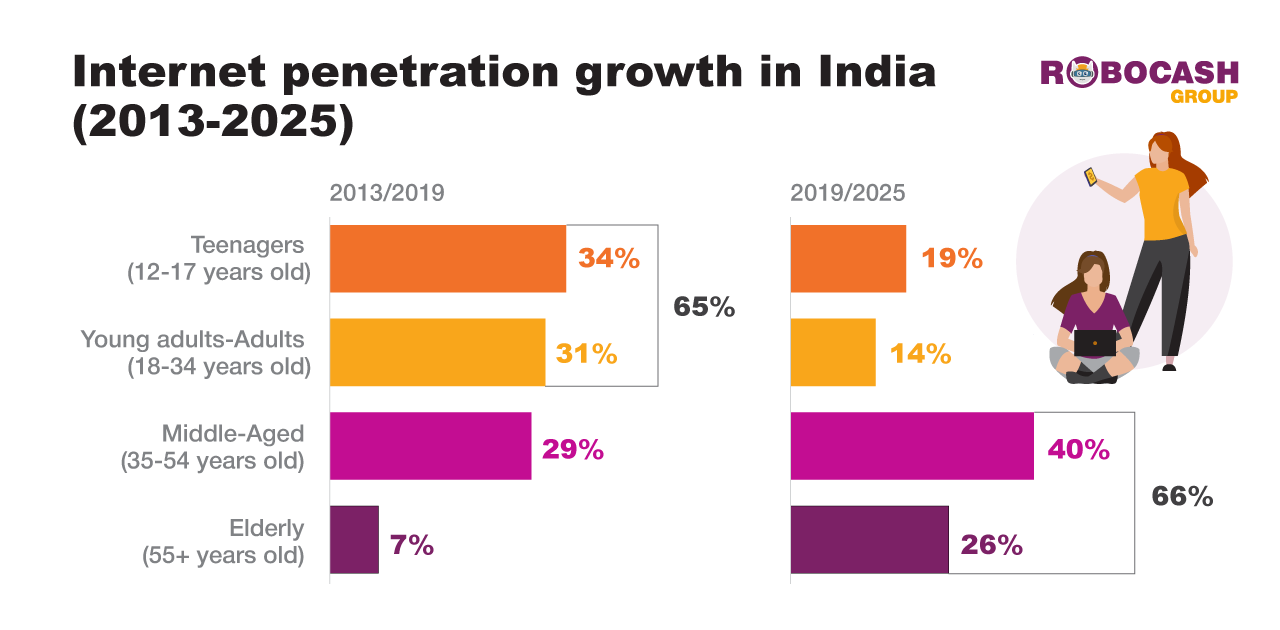

The young adults and adults (18-34 y.o) in India comprise the largest share (35%) of all Internet users. However, despite the growth in absolute numbers, the age group of young adults has lost almost 20 p.p. of the share for the period from 2013 to 2019 due to the faster growth of other generations.

According to the Robocash Group’s forecast, the share of young adult Internet users will continue to decline, compared to the middle-aged generation (35-54 y.o). The share of the teenage population group will not grow as quickly in the future, resulting in the 3.4 p.p. loss in the coming years.

Due to government programs and the necessity to use online services, the middle-aged and elderly population will begin actively using the Internet at faster rates. Therefore, by 2025 we can expect an increase in the share of the middle-aged by 32%, and in the elderly generation (55+ y.o.) up to 12.0%.

Thus, 94 million and 62 million from the middle-aged and elderly age groups respectively are forecasted to become Internet users by 2025. This will lead to a shift in the age breakdown structure, as the prevailing share will then belong to the middle-aged people. The shares of the young adults and middle-aged Internet users will become roughly equal, thereby having equivalent potential and influence on fintech services.

Robocash Group’s analysts comment that this change in the structure of Internet users will have a direct impact on the fintech industry, increasing the significance of the middle-aged and elderly population as a target audience. 11% of middle-aged and 14% of seniors will almost certainly start using fintechs frequently or consistently. In this regard, fintech companies will presumably turn to online education and training of the middle-aged and elderly generations in order to expand the target audience.

The report analyses digitalisation in India broken down by four main age groups:1. Teenagers – 12-17 years old; 2. Young adults-Adults – 18-34 years old; 3. Middle-aged – 35-54 years old; 4. Elderly – 55 years old and older.