Bored of American Dividend Kings… These Two Canadian Stocks Have Increased Their Dividend Yield

In 2023, Canadian dividend stocks experienced rising payouts. Saqib, a financial analyst at Trading.Biz, thinks the trend will continue in 2024, and these two Canadian stocks are worth looking for for juicy dividends.

The Canadian stock has performed well in 2023 and can continue the trend this year.

An increase in yield and longstanding dividend history can provide some lucrative opportunities.

At this point, two stocks can be a good option for long-term holding.

But why Canadian stocks?

He says that you are constantly looking for gems as an investor, and 2023 has proven to us that founding gems can be difficult. So, why not look towards the good ol’ north?

He said, “Dividend stocks in Canada displayed robust performance in the previous year, with the overall market rebounding 8%. I am optimistic about the overall outlook of dividend stocks, which is reflected perfectly in these two stocks.”

The National Bank of Canada (NA: TSX) is the first on the list. The stock returned about 15% overall, with a dividend yield of 4% or higher.

Saqib thinks that despite banking crises in the US, public trust among the banks remained quite high. Over the previous five years, National Bank (NA: TSX) has raised the largest dividends of any Canadian bank. The last dividend payout per share was C$1.06, about $0.79. He predicts a 2-3% rise in the dividend in the next five years.

NA: TSX stock analysis

The stock is trading above the 200-day MA. It recently broke the 104-handle to trade at an all-time high. The next resistance for the stock lies at 104. If it breaks this level, it can go towards 106. Even though NA is slightly overbought right now, any dip buying can be helpful.

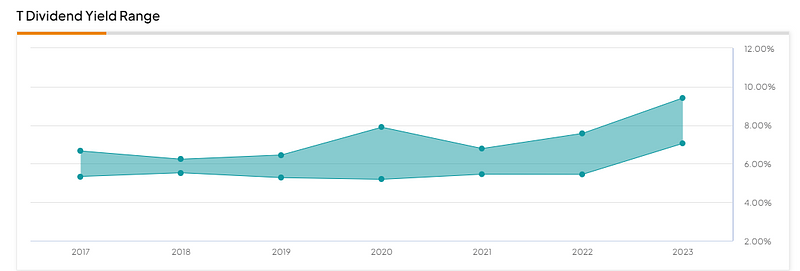

The next on the list is Telus Corp (T: TSX). Telus offers a range of services from telecommunication to health. Telus (T: TSX) increased its dividend payout from C$0.36 to C$0.38 in the last quarterly result.

The stock has an annual dividend yield of 6.08%. According to him, the stock has given uninterrupted dividends for the past 19 years, which makes it attractive. And he thinks we can see an increase of 1-2% in the next five years.

Telus (T: TSX) stock analysis

The stock has been trading downwards since Jan 24, 2024. The price is slightly below the 200-day MA. However, he thinks it’s a good buying opportunity at 23.19, its support level. The next resistance is at 24.61. If it breaks above this level, the price can go towards 25.94.