Primus Partners and EBTC Report Highlights 29% Savings for Buses, 24% for Trucks across the lifespan

National, 19 January 2024: Primus Partners and EBTC (European Business and Technology Centre) have jointly commissioned a report titled RETROFIT FOR A GREENER FUTURE: Accelerating electric vehicle adoption. The report advocates for nationwide pilot programs, targeting 10 million green kilometers, to showcase retrofitting’s potential in urban applications such as garbage collection, water tanker operations, logistics, etc. The extensive report accentuates the economic appeal of retrofitting existing vehicles over acquiring new EVs, with the commercial segment reaping significant benefits. As cities and businesses spotlight sustainability, retrofitting emerges as a transformative solution, economically advantageous and efficient.

Mr. Davinder Sandhu, Chairman and Co-Founder, Primus Partners, at the unveiling of the report, said “The report provides a comprehensive outlook on the role of retrofitting in India’s green future. It offers a pragmatic examination of appropriate regulatory facilitation, cost implications, and incentives that will underpin retrofitting’s place in our EV adoption strategy. The document also encapsulates the contributions and insights from policymakers, industry leaders, and regional stakeholders, united in the commitment to forging an electrified road ahead”.

Sharing his insights on the report titled “RETROFIT FOR A GREENER FUTURE: Accelerating electric vehicle adoption”, Mr. Anurag Singh, Managing Director, Primus Partners, said “At a time when the switch to EVs is becoming not just preferable but necessary, the report argues for retrofitting as a key strategy in our transition to electric mobility. It presents findings from recent research, market analysis, and policy studies to build a case for retrofitting as a means to extend the life of current vehicles while reducing overall emissions.”

Circular Economy

Retrofitting is in harmony with the circular economy’s focus on maximizing resource efficiency and minimizing waste. This approach diverges from the traditional ‘take-make-dispose’ model, advocating instead for a ‘reduce, reuse, recycle’ strategy, aptly demonstrated in EV retrofitting. This process not only maintains the energy and materials initially invested in manufacturing vehicles by converting them to electric but also greatly prolongs their lifespan. Additionally, retrofitting can invigorate local economies, generating jobs in retrofitting services, driving innovation in EV technology, and creating a demand for recycled EV batteries and components. Retrofitting a truck reuses 3.5 tons of steel and saves approximately 5.25 tons of CO2 emissions per truck; scaling this to 1000 trucks results in a total CO2 emission saving of 5.25 kilotons.

Industry Outlook

As India strides forward in its commitment to the Paris Agreement and its own nationally determined contributions (NDCs), fostering a robust EV retrofitting ecosystem becomes pivotal. Market analysis suggests that the retro-fitting sector is currently in its infancy, it exhibits significant potential for expansion due to technological simplicity and accessibility. As of 2023, the global retrofit vehicle market is estimated to be valued at USD 65.94 billion and projected to reach USD 125.37 billion by 2032 with a noteworthy CAGR of 7.40%.

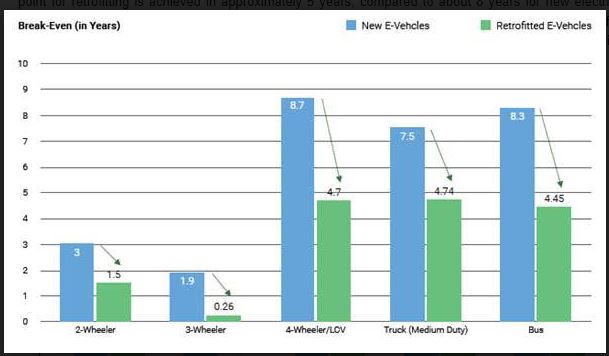

Retrofitting generally offers a quicker ROI across all vehicle types compared to purchasing new EVs. In the case of medium-duty trucks, the breakeven point for retrofitting is achieved in approximately 5 years, compared to about 8 years for new electric vehicles. This faster attainment of breakeven is influenced by the substantial annual fuel savings, which contribute significantly to recouping the retrofitting costs. Similarly, for buses, the breakeven for retrofitted electric vehicles is reached in around 4 years, which is notably quicker than the 8 years required for new electric vehicles.

Primus Partners’ extensive report accentuates the economic appeal of retrofitting existing vehicles over acquiring new EVs, with the commercial segment reaping significant benefits. As cities and businesses spotlight sustainability, retrofitting emerges as a transformative solution, economically advantageous and efficient. The report details Total Cost of Ownership (TCO) savings that cannot be overlooked, particularly in the heavy-duty vehicular segment. The fiscal analysis exhibits that retrofitting a truck is 24% cheaper in travel cost per km in TCO terms than its new EV counterpart, an undeniable incentive for businesses eyeing both sustainability and bottom-line considerations. Similarly for buses, where retrofitting presents an even greater reduction, marked at 29% cheaper travel cost per km in TCO terms than a brand-new EV bus.

Policy Recommendations

To counter the potential risks associated with retrofitting, a collaborative effort between the government and the industry players is imperative. Government subsidies and incentives can play a crucial role in making retrofitting economically viable. Public-private partnerships can foster collaboration between government bodies and private companies specializing in EV technologies, supporting joint ventures for the development and distribution of retrofitting kits.

Scaled Pilots

· Launch Scaled Pilots for EV Retrofitting targeting the conversion of 200 buses to assess operational feasibility, with each bus covering 50,000 kilometers annually in urban environments.

· Secure funding and financial support, potentially from international bodies.

· Collaborate with key governmental bodies and stakeholders, led by agencies like NITI Aayog and the Ministry of Road Transport and Highways (MoRTH)

Proposed Subsidies

· There could be a provision of a subsidy of up to 40 lakhs per retrofitted truck, with eligibility based on satisfying Domestic Value Add (DVA) criteria.

· A suggested policy intervention includes securing a 20 lakh INR subsidy per retrofitted bus. This subsidy would be contingent upon DVA criteria, providing financial relief for the retrofitting industry.

· A similar approach can be followed in the 2W, 3W, and 4W segments for their retrofitted counterparts.

Interest Subvention

· Address financing challenges by implementing favorable loan interest rates, specifically “5 to 6%,” which should extend to the establishment of charging infrastructure for retrofitted vehicles.

Exemption from scrappage policy

· Section 8 of the Motor Vehicles (Registration and Functions of Vehicle Scrapping Facility) Rules, 2021 – “Criteria for scrapping of vehicles” mandates scrapping of government vehicles that are older than 15 years. Mandatory scrapping should not be applicable for government vehicles that are retrofitted.

Revised GST rate

· The GST framework for EVs and retrofitted EVs in India presents a varied rate structure. Fully built EV buses benefit from a lower GST rate of 5%. There is no provision for an EV Retro fitment kit in GST.

· Spare batteries and essential components for EVs are levied with an 18% GST. It is proposed that when a retro fitment EV kit is purchased, it should be charged at 5% to lower the cost of conversion in line with EV vehicle purchase to accelerate the adoption of electric mobility solutions.

States with specific retrofitting policy

· Building on the Delhi Government’s initiative that allows older petrol and diesel two-wheelers, three-wheelers, and four-wheelers to continue operating post-NGT age restrictions (10 years for diesel and 15 for petrol) if retrofitted with EV kits, it is imperative for other states to establish their guidelines.

· The Delhi Government is well-positioned to expand its progressive policy framework to encompass commercial vehicles, such as trucks and buses. By doing so, it can serve as a pioneering example for other states, establishing a replicable model for retrofitting policies at a pan-India level.

Other recommendations

· Exemptions for retrofitted vehicles from plying and parking restrictions will likely generate significant private sector interest, mimicking the success seen in the e-LCV segment.

· Proposals also extend to recommendations for excusing retrofitted vehicles from the Environmental Compensation Charge (if applicable), municipal taxes, and parking fees. As the current numbers of retrofitted vehicles are modest, these exemptions are projected to have minimal impact on revenue streams.

· Incentivizing the deployment of DC high-power charging solutions is critical to support the rapid incorporation of retrofitted vehicles in a diverse range of applications.

· Allow retrofitted commercial vehicles to operate round the clock in urban areas.

Way Forward

India’s Vehicle Scrappage Policy introduced by the government is aimed at phasing out old and unfit vehicles and replacing them with newer, more environmentally friendly ones. This policy is governed by various factors including the fitness and emission levels of vehicles rather than solely their age. Commercial vehicles over 15 years and passenger vehicles over 20 years of age are subjected to increased re-registration fees or scrapping under this policy. Instead of scrapping old vehicles, the government could provide incentives or support initiatives to retrofit these vehicles to run on electric power. This way, the lifespan of existing vehicles is extended. Moreover, retrofitting could also offer a pathway to modernizing the existing vehicle fleet, while simultaneously reducing emissions and aligning with the broader sustainability goals of a circular economy.

In conclusion, transitioning ICE vehicles to EVs through retrofitting presents a spectrum of challenges. However, with a coordinated approach involving government initiatives, industry collaboration, and public engagement, these challenges can be effectively addressed and overcome. Retrofitting is more than a temporary solution; it’s a significant step towards sustainable mobility, demonstrating a commitment to environmental stewardship.