Ugro Capital Announces Financial Results

Mumbai, January 25, 2024: U GRO Capital, a DataTech NBFC and India’s largest Co-lender in the MSME segment, today announced its robust financial performance for the Quarter and Nine-month Period ended 31st December 2023, marking a historic achievement as the company enters the prestigious Billion Dollar AUM Club.

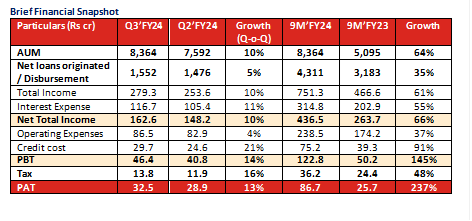

Brief Financial Snapshot

The Company continued its growth momentum in the third quarter of FY24 with AUM of INR 8,364 Cr (as on Dec’23), up 64% compared to Dec’22. This surge can be attributed to its strategic investments in distribution channels, expansive lender base, and a data-centric underwriting model, which together ensure consistent monthly disbursals of over INR 500 Cr.

Financially, U GRO Capital highlighted a Total Income of 751.3 for 9M’24 (up 61% compared to 9M’23), while the figure stood at INR 279.3 Cr for Q3’24, up 47% YoY and 10% QoQ. Furthermore, the PAT for 9M’24 scaled up to INR 86.7 Cr, up 237% YoY and was INR 32.5 Cr for Q3’24, indicating an increase of 148% YoY and 13% QoQ. The robust quarterly performance, alongside the optimal GNPA/NNPA metrics of 2.0%/1.1% on the total AUM, reiterates the sterling quality of UGRO’s portfolio, underscoring a well-structured risk management approach.

U GRO Capital’s distinctive co-lending approach combined with the strategic use of co-lending partnerships with off-book AUM accounting for 45% has significantly propelled this growth trajectory. Further solidifying its reputation in the sector, U GRO Capital’s proprietary underwriting model, GRO Score 3.0, has demonstrated its efficacy. This strategic model, along with collaborations with over 10 co-lending partners, 55 lenders, 40 fintechs, and 500 GRO partners, facilitates data-driven, tailored financial solutions for more than 67,000 MSMEs across India.

Mr. Shachindra Nath, Founder and Managing Director of U GRO Capital said, “At U GRO Capital, our journey is defined by continuous innovation, dedicated to reshaping financial sector standards. Today, we proudly announce surpassing INR 8300 crores in AUM, entering the Billion Dollar AUM Club. This accomplishment reflects our unwavering commitment to innovation and delivering unmatched financial solutions. Committed to boosting India’s economic growth, we aspire to build a significant institution for small business financing. With ambitious FY24 goals, we are strategically poised to achieve them through innovative strategies, collaborations, and a steadfast commitment to sustainable entrepreneurship. U GRO Capital offers an attractive opportunity for investors seeking enduring growth and robust returns.”

Key performance highlights for Q3’ and 9M’FY24

Growth, Expansion and Portfolio quality

- AUM of INR 8,364 Cr as on Dec’23 (up 64% YoY and 10% QoQ)

- INR 1,552 Cr of Net Loans originated in Q3’FY24 (up 33% YoY and 5% QoQ) and INR 4,311 Cr of Net Loans originated in 9M’FY24 (up 35% compared to 9M’FY23).

- Total Income stood at INR 279.3 Cr for Q3’FY24 (up 47% YoY and 10% QoQ) and INR 751.3 Cr in 9M’FY24 (up 61% compared to 9M’FY23)

- Net Total Income stood at INR 162.6 Cr for Q3’FY24 (up 51% YoY and 10% QoQ) and INR 436.5 Cr in 9M’FY24 (up 66% compared to 9M’FY23)

- PBT increased to INR 46.4 Cr in Q3’FY24 (up 109% YoY and 14% QoQ) and INR 122.8 Cr in 9M’FY24 (up 145% compared to 9M’FY23)

- PAT increased to INR 32.5 Cr in Q3’FY24 (up 148% YoY and 13% QoQ) and INR 86.7 Cr in 9M’FY24 (up 237% compared to 9M’FY23)

- GNPA / NNPA as on Dec’23 stood at 2.0% /1.1% (as a % of Total AUM)

- Over 67k customers as on Dec’23

- 104 branches (as on Dec’23)

Liability and Liquidity Position

- Total lender count stood at 58 as on Dec’23

- Total Debt stood at INR 4,173 Cr as on Dec’23, and overall debt-to-equity ratio was 3.0x

- Healthy capital position with CRAR of 22.3% (as on Dec’23)